“Welcome to the dynamic world of real estate market cycles, where housing trends ebb and flow in response to economic shifts, consumer behavior, and external factors. In this introduction, we delve into the significance of housing alerts as invaluable tools for navigating these ever-changing cycles.real estate market cycles. From understanding the stages of market expansion to identifying opportune moments for buying or selling, housing alerts serve as beacons of insight, guiding stakeholders through the complexities of real estate investment. Join us as we explore how these alerts empower buyers, sellers, investors, and professionals alike to make informed decisions and thrive in the dynamic landscape of the housing market.”

Table of Contents

Navigating Real Estate Market Cycles: The Role of Housing Alerts

Introduction:

Welcome to the intricate world of real estate market cycles, where housing trends fluctuate in response to economic factors, consumer behavior, and industry dynamics. In this comprehensive guide, we delve into the pivotal role of housing alerts as indispensable tools for understanding and navigating the nuances of these cyclical patterns. From decoding the stages of market expansion to leveraging strategic opportunities for buying or selling, housing alerts serve as invaluable compasses, guiding stakeholders through the complexities of real estate investment. Join us as we explore the intricate interplay between housing alerts and market cycles, empowering buyers, sellers, investors, and professionals to make informed decisions in the ever-evolving realm of real estate market cycles.

I. Understanding Real Estate Market Cycles

A. Phases of Market Cycles:

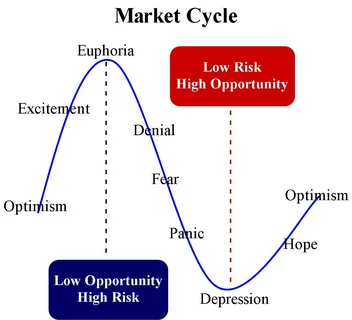

- Real estate market cycles typically consist of four distinct phases: expansion, peak, contraction, and trough. During the expansion phase, demand for housing rises, leading to increasing prices and robust market activity. Peaks mark the culmination of growth, followed by contractions characterized by declining prices and reduced demand. Troughs represent the bottom of the cycle, setting the stage for the next phase of expansion real estate market cycles.

B. Economic Indicators and Market Trends:

- Various economic indicators, such as GDP growth, employment rates, interest rates, and consumer sentiment, influence real estate market cycles. Understanding these indicators and tracking market trends is essential for interpreting housing alerts accurately real estate market cycles.

II. The Importance of Housing Alerts

A. Strategic Decision-Making:

- Housing alerts provide timely insights into market shifts, enabling stakeholders to make strategic decisions regarding buying, selling, investing, or renting properties. By staying informed about changing market conditions, individuals can capitalize on opportunities and mitigate risks effectively real estate market cycles.

B. Risk Management:

- Effective risk management is crucial in real estate investment. Housing alerts serve as early warning systems, allowing investors to identify potential risks and adjust their strategies accordingly. Whether navigating market downturns or capitalizing on emerging trends, informed decision-making is key to mitigating risks and maximizing returns.

III. Early Warning Signs and Key Indicators

A. Interest Rate Movements:

- Changes in interest rates can significantly impact real estate market dynamics. Rising interest rates may deter buyers, leading to decreased demand and lower property prices. Conversely, declining interest rates often stimulate housing activity, driving up prices and increasing demand.

B. Housing Inventory Levels:

- Fluctuations in housing inventory levels offer valuable insights into market conditions. A surplus of inventory may indicate a buyer’s market, with increased bargaining power for buyers and downward pressure on prices. Conversely, low inventory levels may signal a seller’s market, characterized by high demand and rising prices.

C. Economic Performance Indicators:

- Economic performance indicators, such as job growth, wage growth, and consumer spending, provide critical context for interpreting housing alerts. Strong economic fundamentals often correlate with robust housing markets, while economic downturns may lead to weakened demand and decreased property values.

IV. Buying Opportunities During Market Downturns

A. Bargain Hunting:

- Market downturns present unique opportunities for bargain hunting. Housing alerts can help identify undervalued properties ripe for investment. Savvy buyers with sufficient liquidity can capitalize on discounted prices and favorable negotiation terms.

B. Long-Term Investment Potential:

- Market downturns offer long-term investment potential for buyers with a strategic outlook. Properties purchased at discounted prices during downturns have the potential for significant appreciation once market conditions improve. By leveraging housing alerts to identify opportune buying opportunities, investors can build a diversified real estate portfolio with strong growth potential.

V. Selling Strategies at Market Peaks

A. Timing and Pricing Strategies:

- Timing is crucial when selling properties at market peaks. Housing alerts can help sellers gauge market sentiment, identify optimal timing for listing properties, and set competitive pricing strategies to maximize returns. By leveraging housing alerts, sellers can capitalize on peak market conditions and achieve favorable outcomes.

B. Positioning for Maximum Value:

- Strategic positioning is essential for maximizing property value at market peaks. Sellers should focus on enhancing curb appeal, staging properties effectively, and highlighting unique selling points to attract qualified buyers. By aligning their selling strategies with market trends identified through housing alerts, sellers can optimize their chances of achieving successful transactions.

VI. Investor Considerations and Strategies

A. Portfolio Diversification:

- Portfolio diversification is key to mitigating risk in real estate investment. Housing alerts can help investors identify opportunities across different market segments, geographic regions, and property types. By diversifying their portfolios strategically, investors can minimize exposure to market volatility and achieve more stable returns over time.

B. Adaptive Investment Strategies:

- Adaptive investment strategies are essential for navigating changing market conditions. Investors should remain agile and responsive to evolving trends identified through housing alerts. Whether adjusting asset allocation, reallocating resources, or exploring new investment opportunities, flexibility is critical to long-term success in real estate investment.

VII. Local Market Dynamics and Considerations

A. Regional Variations:

- Real estate market cycles exhibit regional variations influenced by local economic conditions, demographic trends, and regulatory factors. Housing alerts tailored to specific geographic regions provide localized insights that are indispensable for informed decision-making.

B. Urban vs. Suburban Markets:

- Urban and suburban real estate markets often exhibit distinct characteristics and cycles. Housing alerts can help stakeholders navigate the nuances of urban vs. suburban markets, identifying opportunities and risks associated with each market segment.

VIII. Data Sources and Analysis Tools

A. MLS Data and Market Reports:

- Multiple Listing Service (MLS) data and market reports offer comprehensive information on housing inventory, sales trends, and pricing dynamics. Housing alerts derived from MLS data provide valuable insights into local market conditions, enabling stakeholders to make data-driven decisions.

B. Economic Forecasts and Predictive Analytics:

- Economic forecasts and predictive analytics leverage advanced modeling techniques to anticipate future market trends. Housing alerts based on economic forecasts and predictive analytics offer forward-looking insights that empower stakeholders to anticipate market shifts and proactively adjust their strategies.

IX. Risk Mitigation Strategies for Stakeholders

A. Due Diligence and Research:

- Due diligence and thorough research are fundamental to effective risk mitigation in real estate investment. Stakeholders should conduct comprehensive analyses of market conditions, property fundamentals, and economic indicators before making investment decisions.

B. Contingency Planning:

- Contingency planning is essential for mitigating unexpected risks in real estate investment. Stakeholders should develop contingency plans to address potential challenges such as market downturns, property vacancies, or unforeseen maintenance expenses.

X. Long-Term Planning and Investment Outlook

A. Strategic Vision and Goals:

- Strategic vision and clearly defined investment goals are critical for long-term success in real estate investment. Stakeholders should align their investment strategies with their financial objectives, risk tolerance, and investment horizon.

B. Adaptive Strategies for Market Resilience:

- Adaptive strategies that prioritize flexibility and resilience are essential for navigating real estate market cycles. Stakeholders should remain agile and responsive to changing market conditions, leveraging housing alerts to inform their investment decisions.

Conclusion: Navigating Real Estate Market Cycles with Housing Alerts

In conclusion, housing alerts play a pivotal role in understanding and navigating the complexities of real estate market cycles. By providing timely insights into market trends, economic indicators, and shifting dynamics, housing alerts empower stakeholders to make informed decisions that align with their investment objectives and risk tolerance. Whether identifying buying opportunities during market downturns, optimizing selling strategies at market peaks, or diversifying investment portfolios strategically, housing alerts serve as invaluable tools for navigating the ever-evolving landscape of real estate investment. As stakeholders embrace data-driven decision-making and adaptive strategies, they can position themselves for success and resilience in the dynamic realm of real estate market cycles.

In conclusion, the journey through real estate market cycles is dynamic and multifaceted, yet armed with housing alerts, stakeholders can navigate with confidence and clarity. These alerts serve as indispensable guides, offering timely insights into the ever-evolving landscape of property markets.

As we’ve explored, understanding market cycles is not just about recognizing peaks and troughs but also about leveraging opportunities and mitigating risks. Whether you’re a buyer seeking to capitalize on market downturns, a seller aiming to maximize profits at market peaks, or an investor diversifying portfolios strategically, housing alerts provide the crucial data points needed to make informed decisions.

Moreover, housing alerts foster a proactive approach to real estate investment, empowering stakeholders to anticipate shifts, adapt strategies, and seize opportunities. By staying attuned to changes in housing inventory, pricing trends, economic indicators, and local market dynamics, individuals can position themselves for success in the ever-changing real estate landscape.

In essence, housing alerts offer more than just information; they offer a pathway to resilience, growth, and prosperity in real estate investment. As stakeholders embrace data-driven decision-making and strategic foresight, they can confidently navigate the twists and turns of market cycles, unlocking the full potential of their real estate endeavors.

So, whether you’re embarking on your first property purchase, refining your investment strategy, or navigating the complexities of selling in a competitive market, remember the power of housing alerts as your trusted companion on the journey through real estate market cycles. With vigilance, adaptability, and a keen eye on the alerts, success in real estate investment becomes not just a possibility but a tangible reality.

Together, let’s embrace the opportunities, weather the challenges, and embark on a journey of growth and prosperity in the dynamic realm of real estate investment, guided by the insights and wisdom of housing alerts.

Frequently asked questions (FAQs) on “Housing Alerts: Real Estate Market Cycles”:

- Q1: What are housing alerts, and how do they work?

- A1: Housing alerts are notifications or updates that provide timely information about changes in the real estate market. They typically include data on housing inventory, pricing trends, market conditions, and other relevant factors. Housing alerts can be delivered through various channels, such as email alerts, mobile apps, or real estate websites.

- Q2: Why are housing alerts important for real estate stakeholders?

- A2: Housing alerts are essential for real estate stakeholders as they provide valuable insights into market trends and dynamics. By staying informed about changes in the real estate market, stakeholders can make better-informed decisions regarding buying, selling, investing, or renting properties.

- Q3: What types of information do housing alerts typically include?

- A3: Housing alerts may include a wide range of information, such as changes in housing inventory levels, fluctuations in property prices, interest rate movements, economic indicators, and market forecasts. They aim to provide stakeholders with a comprehensive understanding of the current state of the real estate market.

- Q4: How can I sign up for housing alerts?

- A4: Signing up for housing alerts is typically straightforward and can be done through various channels. Many real estate websites and platforms offer the option to subscribe to email alerts or notifications. Additionally, there are mobile apps specifically designed for delivering housing alerts to users’ devices.

- Q5: Can housing alerts help me identify buying opportunities in the real estate market?

- A5: Yes, housing alerts can be valuable tools for identifying buying opportunities in the real estate market. By tracking changes in housing inventory levels, pricing trends, and market conditions, stakeholders can pinpoint areas where property prices may be lower or where demand is high, presenting favorable buying opportunities.

- Q6: How accurate are housing alerts in predicting market cycles?

- A6: While housing alerts provide valuable insights into market trends, they are not infallible predictors of market cycles. Market dynamics can be influenced by various factors, including economic conditions, regulatory changes, and unforeseen events. Therefore, it’s essential to use housing alerts as one of many tools for analyzing market conditions.

- Q7: Can housing alerts help me time the sale of my property for maximum profit?

- A7: Yes, housing alerts can assist sellers in timing the sale of their property for maximum profit. By tracking changes in market conditions, such as increases in property prices or shifts in buyer demand, sellers can identify optimal timing to list their property and achieve favorable outcomes.

- Q8: Are housing alerts available for specific geographic regions or markets?

- A8: Yes, housing alerts are often tailored to specific geographic regions or markets. Real estate websites, platforms, and apps may offer localized housing alerts that provide insights into market conditions, pricing trends, and inventory levels specific to a particular area or market segment.

- Q9: How frequently should I check housing alerts?

- A9: The frequency of checking housing alerts may vary depending on individual preferences, market conditions, and investment goals. Some stakeholders may prefer to check housing alerts daily or weekly to stay updated on market trends, while others may check them less frequently.

- Q10: Can housing alerts help me mitigate risks in real estate investment?

- A10: Yes, housing alerts can help stakeholders mitigate risks in real estate investment by providing timely information about changes in market conditions. By staying informed about potential risks, such as market downturns or shifts in demand, stakeholders can adjust their investment strategies accordingly and minimize exposure to risk.

Nextezone: Igniting Tomorrow's Potential with Innovation Today Innovate. Explore. Elevate. Nextezone – Where Vision Meets Innovation.

Nextezone: Igniting Tomorrow's Potential with Innovation Today Innovate. Explore. Elevate. Nextezone – Where Vision Meets Innovation.